Ever feel like you’re just playing whack-a-mole with charts? I was there. Then I started using hard data to spot the recurring rhythms in crypto.

This platform reveals exactly which months and weeks have historically favored each major coin. Instead of wondering “Should I buy now?” I now ask: “What’s the historical tendency for ETH in October?” The interactive charts highlight periods with a 78.5% bullish win rate—that’s a real edge, not a hunch.

Here’s how it changed my trading:

1.

Smarter Entries: I trade patiently. If Q1 is typically weak for an asset, I wait for better odds. The intra-month analysis refines my timing.

2.

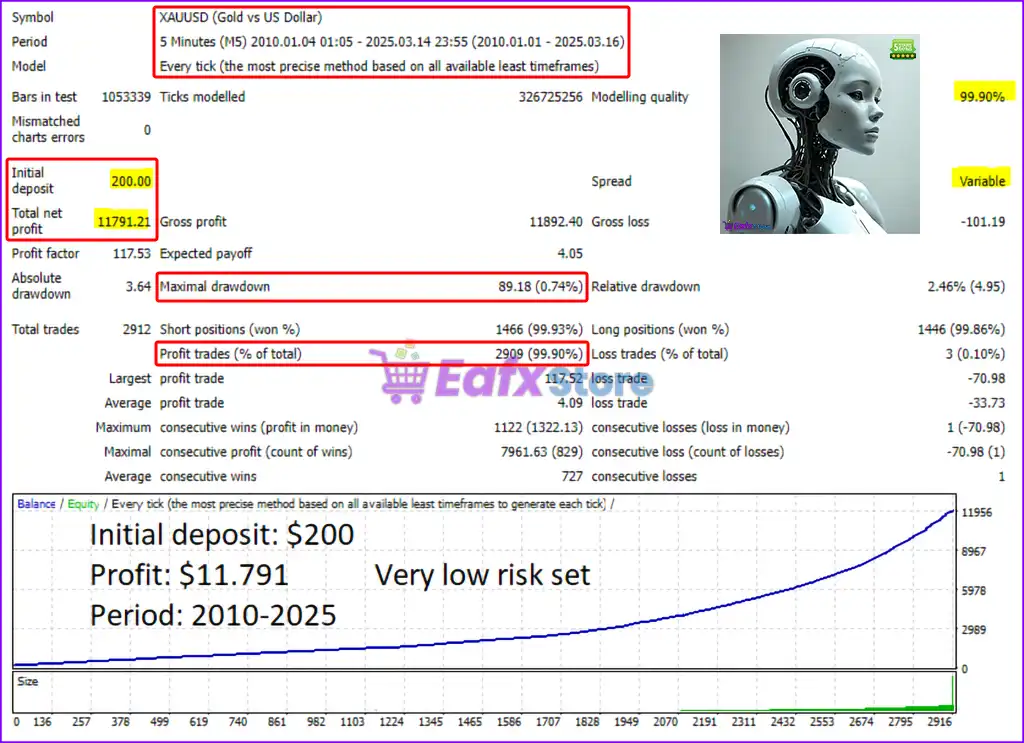

Better Risk Management: Pre-build Backtest Library I use it to secure profits ahead of historically rough months. Anticipating these has protected my capital.

3.

Validating Strategies: Hearing rumors about a “January Effect” is meaningless. Backing it with multi-cycle data turns noise into a confident plan.

I now consult it before any sizable trade. I review the overall trend, Instant backtests examine the weekly segments, and factor in volatility patterns. It’s not a crystal ball, but it’s the ultimate market calendar.

Stop trading in the fog of war. Start trading with the data on your side. Explore the charts:

Crypto Seasonal Historical tendencies

Home From Trading Hype to Trading History: My Crypto Edge